Software is Dead, Long Live AI Services!

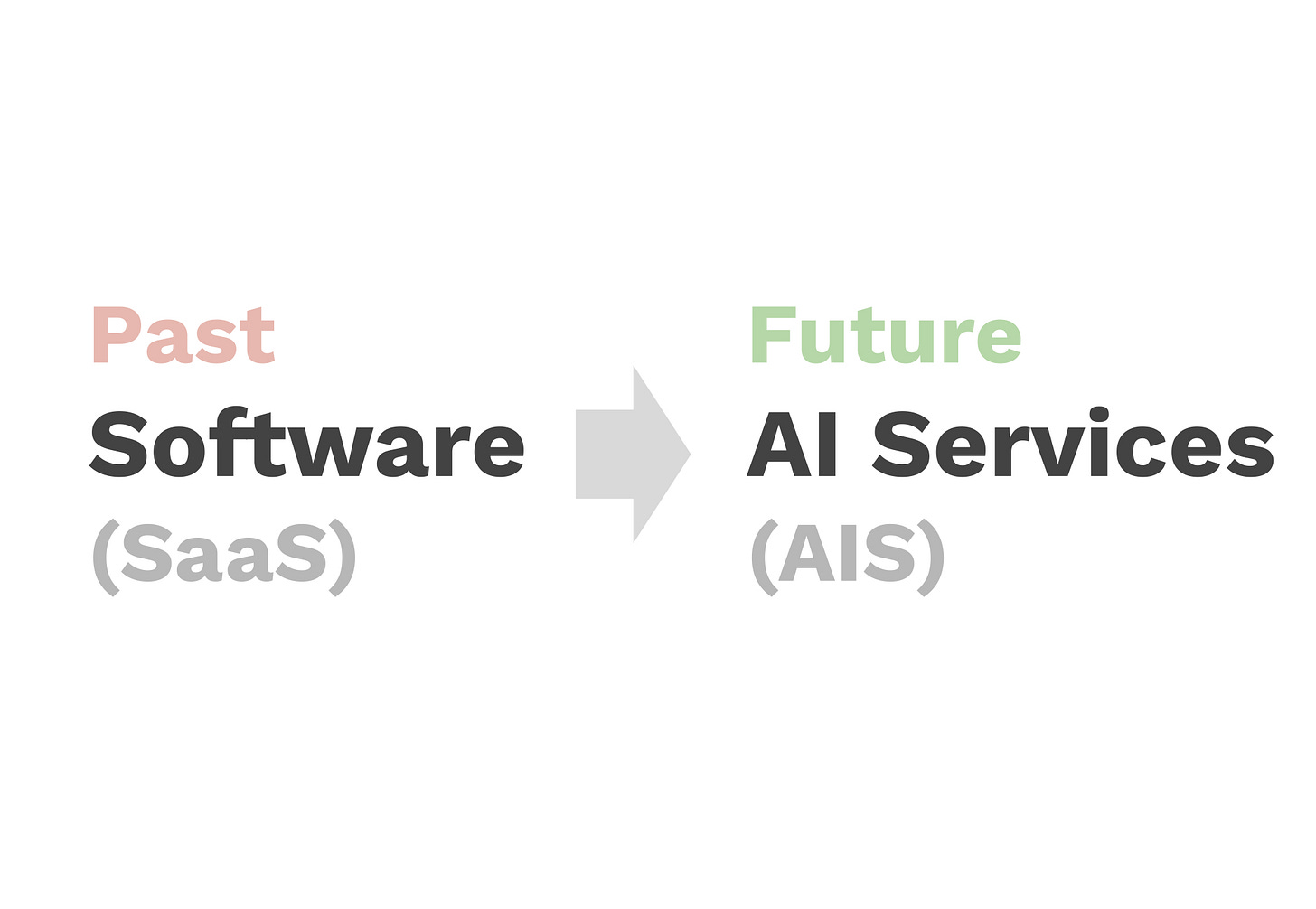

2024 marks the end of software as we know it and the rise of AI services, a new model of delivering services to consumers and business better, cheaper, and faster using AI

R.I.P. Software. We’re in the age of AI services now.

I have worked in the software industry for 10 years, and studied the industry for longer. Based on what I see in the market today, we are at a transition point from software to AI services (which I call “AIS” for short).

Over the next 10 years, I predict that we see a new cohort of AIS companies become large, sustainable businesses in industries such as accounting, insurance, real estate, healthcare, freight, waste management, law, education, IT, travel, and even parts of government. New AIS companies will follow a pattern of Disruptive Innovation, as studied by Clayton Christensen.1 They will be full-stack startups that deliver much cheaper versions of the services that businesses and consumers buy today, typically targeting underserved segments of these markets. AIS companies will have margins similar to software businesses, and they will achieve unprecedented scale in previously fragmented markets.

AI Services (“AIS”): services business where the majority of the work is done by artificial intelligence. AIS firms typically have a human professional review the work before delivering the final product, but this may not always be the case. AIS replaces the old service delivery model where the vast majority of value was created by humans, with slight efficiency gains from workflow software.

Below, I discuss the history of how we got here, and some of my thoughts on how to successfully ride this wave.

2015 to 2021: The Heyday of Vertical Software

My first job out of college was in management consulting at one of the largest services firms in the world, Deloitte. As a first-year analyst, my job was to tag along with the senior professionals and take notes in meetings with the CEOs of large companies across different industries (Newspapers, Banks, Healthcare, Insurance, etc). From what I heard in those conversations, it was obvious in the 2010s that the internet and software were the biggest trends in every industry I was exposed to. CEOs were afraid of being disrupted and losing to more tech-savvy competitors, so they were investing heavily in new software. That’s a big part of why I decided to found ProcureNow, a software company. We were one of two modern software companies competing in our category.

2021-2023: The Death of Software

After my previous startup was acquired, I considered where to build my next business. Software became extremely competitive in the 2015-2021 cycle, and there were multiple venture-backed startups pursuing all of the obvious opportunities I saw to build software. I was 100% focused on my software business for years and I rarely lifted my head to scan the broader technology landscape to learn about what was going on outside my immediate industry. My gut was telling me that we were at the end of the cycle with software, and that nagging feeling forced me to think bigger.

2024-2034: The Rise of AI-Enabled Services (AIS)

I took a step back and asked, where are the big technology waves that I could ride for the next 10 years? The biggest and most obvious wave I see in application-layer technology is AIS. Instead of selling software to industries, there are bigger businesses to be built by being a full-stack startup and competing directly with incumbents in services industries. Services are the area most immediately at risk of AI automation. “Services” was a dirty word in Silicon Valley, but now AIS is the most exciting opportunity in tech. $22 trillion of US services revenue is at risk of disruption.2

How to Win in AIS

To build a successful business in AIS, there are two ingredients that are unique from software startups: (1) picking the right services industry and (2) operational excellence.

Before diving in, it is worth noting that this is not an exhaustive list of factors to consider when building a new business — it is just a shortened list of variables that I think are unique and worth considering for AIS companies. If you’re looking for a more wholistic framework for picking business ideas, check out my writing on that topic here.

Picking the Industry for AIS:

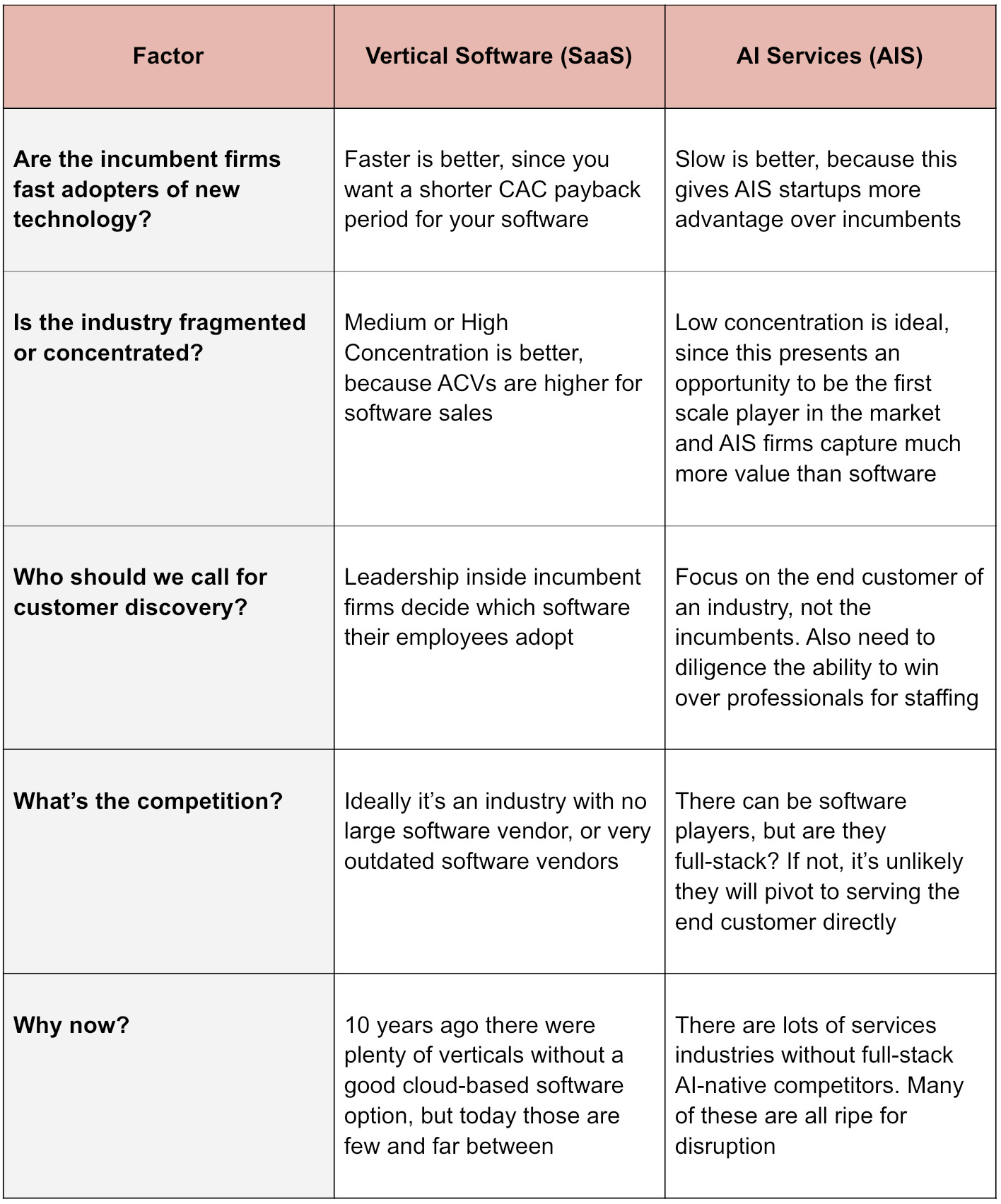

The factors that make an industry good for vertical software are different and oftentimes the opposite of what makes a good industry for the AIS playbook. Here are a few dimensions that I think are worth considering:

Executing Well in AIS:

Building a full-stack startup is more complex than pure software, as it typically includes building out all the major functions of an incumbent in a given industry, as opposed to just focusing on the software. These businesses require leaders with more operational sophistication and the patience for people management. Here are a few key aspects of executing well on an AIS company that may be unique:

Stay focused on gross margins: In traditional software companies, you can have a relatively lean team (and high gross margins of 60-80%). But traditional services firms require human labor as the core offering can have gross margins as low as 20-50%. The hope of AIS is that gross margins could be 60-70% by using AI to improve efficiency.

Invest in service quality and people management. This is the “services” piece in AIS. Managing large teams of service professionals is a different skill that most tech companies do not need to think about. Some full-stack startups have failed because they neglected service quality, and that will also be true with this next wave.

Inorganic growth opportunities: The universe of M&A targets for software companies is much more limited. Services industries typically contain tens or hundreds of thousands of firms. While organic growth will many times still be the best path to scale, the opportunities for M&A will be much more abundant, and we will likely see successful exits this way.

Entrepreneurs who pick the right markets and execute the AIS playbook well will have a high likelihood of success over the next 10 years.

I’m excited about building, advising, and investing in these types of startups, so please feel free to reach out if you are interested in discussing these ideas further.

R.IP. Software. We’re in the age of AI services now.